According to the Deputy Minister of Finance in Vietnam, inflation in Vietnam has been consistently kept at a stable level for a decade since the lessons learned from 2009.

Vietnam’s Inflation Remains Under Great Control

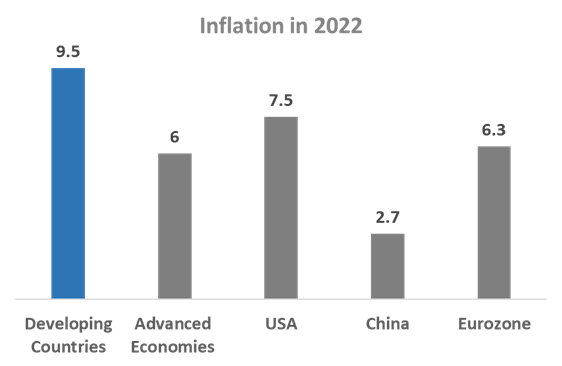

Vietnam still remained among the countries with relatively low inflation compared to the global average. The Consumer Price Index (CPI) in December 2022 rose by 4.55% compared to the same period the previous year. Throughout 2022, the average CPI increased by 3.15% compared to 2021, which was lower than the target of around 4% set by the National Assembly.

Despite the impact of inflation, Vietnam has managed to maintain a positive growth trend for its economy, within 2022, Vietnam achieved an impressive GDP growth rate of 8.02%. With stable political and economic conditions, Vietnam continues to be recognized as an attractive investment destination, even amidst the economic crisis. Vietnam has attracted 839 FDI projects totaling $21.48 billion since 2009. Within 2022, FDI reached a new record of nearly $27.72 billion, with realized capital at $22.4 billion, a notable 13.5% increase compared to 2008.

Investing During Inflation: What to Buy?

Inflation, although currently under control in Vietnam, remains a persistent concern. In a time of persistent inflation risks, diversifying investments across multiple asset classes becomes crucial to protect against the erosion of wealth.

As inflation spreads across the global economy and central banks race to increase interest rates to prevent rising prices, concerns about economic recession dominate the financial market.

This raises a crucial question: which investment channels are investors should choose to allocate their funds?

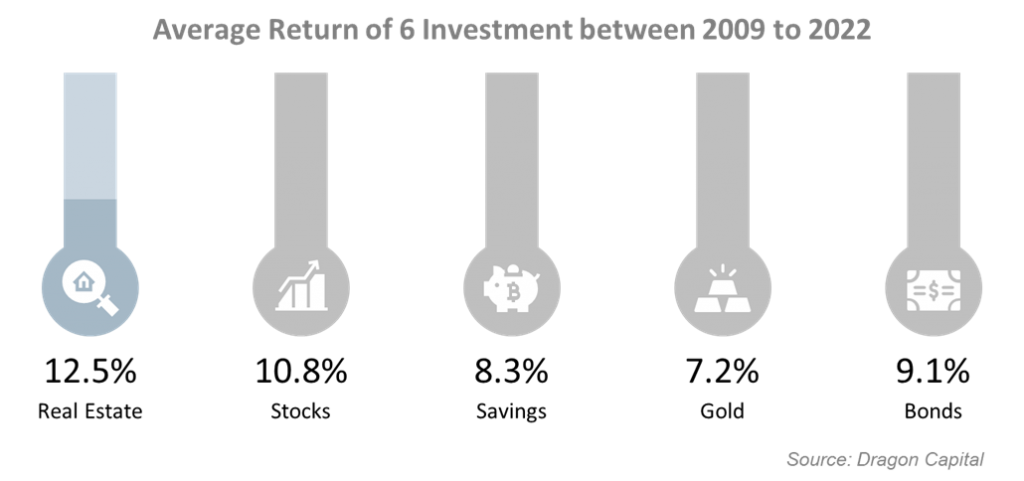

Based on the statistical report by Dragon Capital in 2022, real estate is currently considered the best long-term profitable investment compared to other financial products. Over the past 15 years, it has shown an average growth rate of 12.5%, higher than stocks (1.7%) and bonds (3.4%). The net profit after deducting inflation in Vietnam’s real estate sector is over 9%, which is an attractive return compared to other countries in the region and the world.

According to Savills Vietnam, if inflation occurs due to economic growth, the demand for real estate will increase, leading to a rise in property values. From a positive perspective, investing in real estate is seen as the best to preserve capital than other investment channels.

Safe Haven in Real Estate

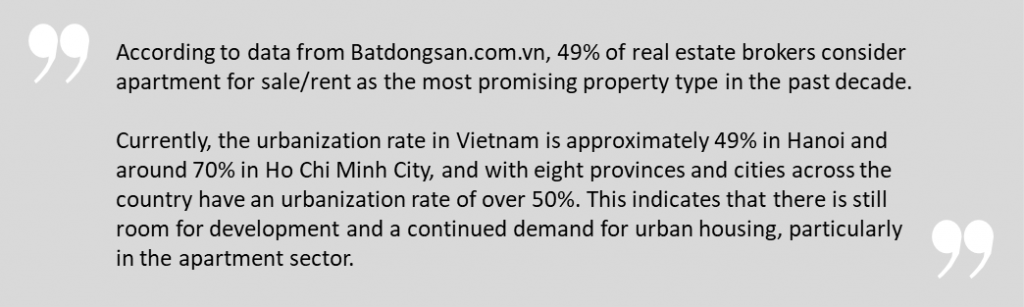

According to experts, the apartment segment in Vietnam is experiencing stable growth, reaching approximately 9% in recent years, with an average rental yield of 3%.

With the current average growth rate and after adjusting for inflation in Vietnam, the estimated return on investment in apartments is around 5%. This is higher compared to advanced-economic countries, where the average return after adjusting for inflation is only around 2-3%. Given the current inflationary environment, apartments can be considered a safe asset with protection against inflation.

Among the markets in Vietnam now, Hanoi and Ho Chi Minh City are the two major attracting significant attention, with Ho Chi Minh City considered to have more potential.

Assessing The Safe Haven Nature of Ho Chi Minh City’s Apartment Real Estate:

The story of two economic downturns, and future potential.

The housing segment in Ho Chi Minh City has witnessed a sharp decline in the supply of affordable housing units since 2008 while experiencing significant growth in the high-end segment.

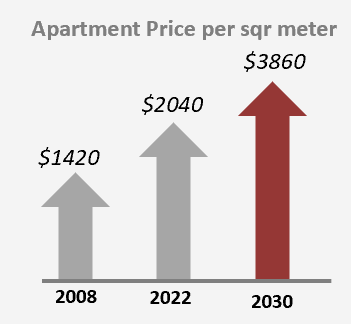

According to experts, the current growth in the supply of apartments still falls short of meeting the market demand in the city, as the majority of real estate buyers are concentrated in this segment. The scarcity of housing supply over the past decade has pushed the average price of apartments to $2040 per square meter, reflecting an average increase of 11% from 2008 until now.

Based on the growth rate of apartments in Ho Chi Minh City during two economic downturns and the current signs of supply shortage, the expectation of future property values reaching $3000 per square meter by 2030, with an average annual increase of 10-11%, is optimistic. This is an attractive growth rate for an investment to hedge against the high inflation currently experienced worldwide and specifically in Vietnam.