From June 12, 2025, Vietnam officially shifts from the model of 63 provinces/cities to 34 provincial-level administrative units. This merger has paved the way for many large urban areas to form, aiming to become specialized centers such as:

Industrial centers: Bac Ninh, Hai Phong, Dong Nai.

Tourism centers: Da Nang, Nha Trang.

Among them, the most prominent is the multi-center HCMC – the country’s economic leader.

This marks a povital moment for HCMC, potentially signaling the start of an extraordinary development phase over the next 30-40 years.

1. The Economic Role Of The New Ho Chi Minh City:

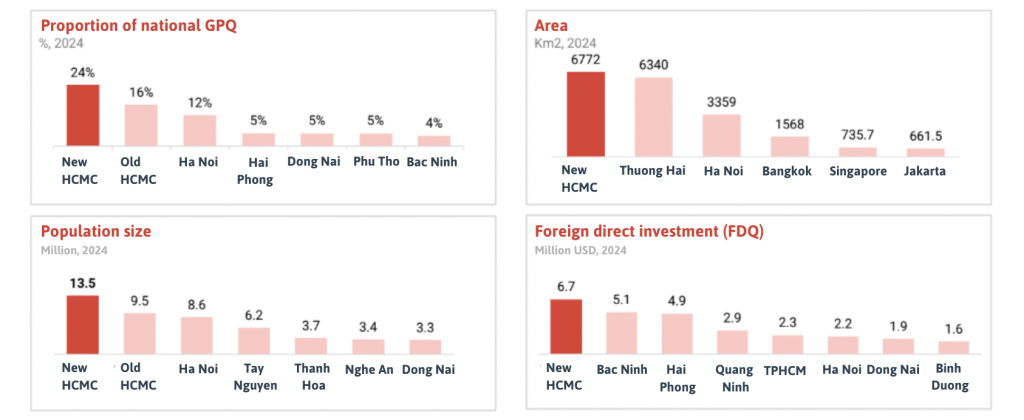

GDP share: Rising from 22% to 25% of the national GDP – twice that of Hanoi (12%).

Population: Rising sharply from 9.5 million to 13.5 million (up 42%), 56% higher than Hanoi (8.6 million).

Area: 6,772 km² – larger than Shanghai (6,340 km²), nearly twice that of Hanoi (3,559 km²).

FDI attraction: Leading the country with USD 6.7 billion, higher than Quang Ninh (USD 5.1 billion) and Hai Phong (USD 4.9 billion).

2. Multi-center Urban Structure – A new “growth engine”

The new Ho Chi Minh City defines 3 centers with clear roles in the supply chain:

– Binh Duong: Industrial production center, equipment, components.

– Vung Tau: Logistics and seaport center, handling transportation.

– Old Ho Chi Minh City: Financial center, R&D, science – technology, strategic coordination.

3. Learning from the Seoul Metropolitan Area (SMA) model

During the research on urban mergers and development models, a key question emerged: is there a comparable case elsewhere in the world, what were its outcomes, and can it serve as a reference point?

One notable example with striking similarities is the Seoul Metropolitan Area (SMA) — a case that may come as a surprise to many.

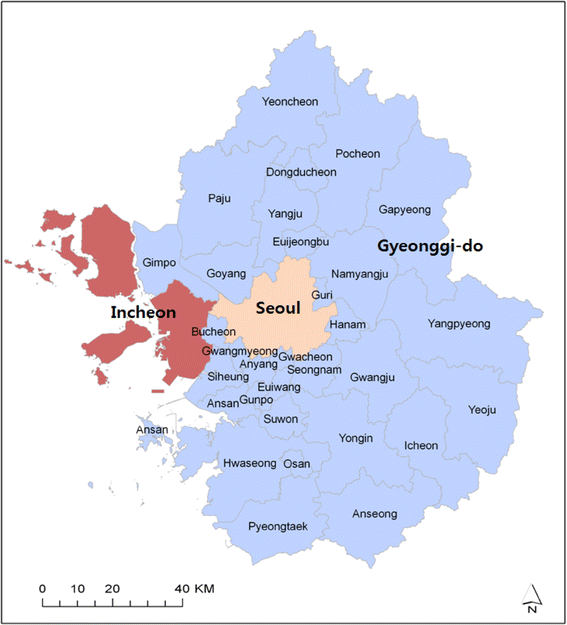

SMA – a successful multi-center urban model of South Korea, established in 1982, includes:

– Seoul focusing on administration, finance, science, technology, R&D

– Incheon, a coastal city focusing on logistics and seaports

– Gyeonggi-do, where large factories of major corporations such as Samsung and LG are concentrated. At this point, we can see some similarities.

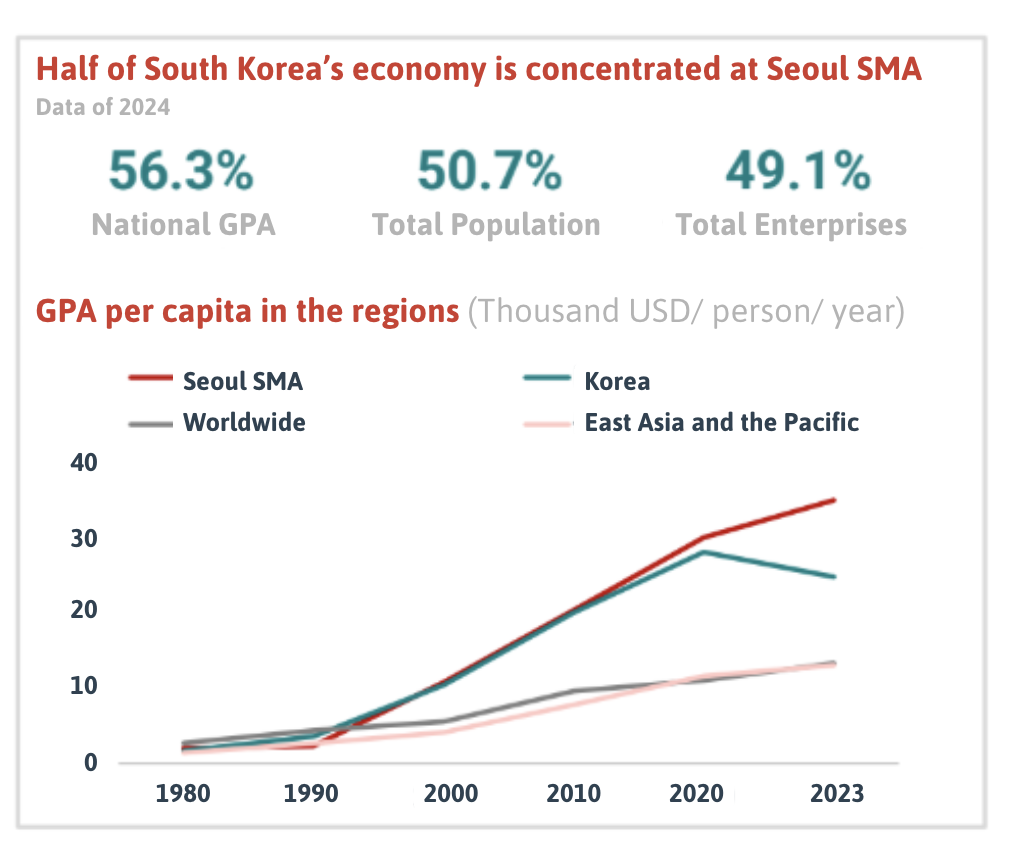

Currently, Seoul SMA contributes:

– 56.3% of South Korea’s GDP

– 50.7% of its workforce

– 49.1% of its national enterprises

Despite facing the global crisis (2020–2023), this area still maintained positive growth – proving a solid foundation. One lesson that the new Ho Chi Minh City can learn from Seoul Metropolitan Area is development focused on each specific zone. The chart shows the contribution ratio of each industry from 1985 to 2023:

– Seoul: Science–technology & management increased from 26% (1985) to 52% (2023).

– Incheon: Logistics increased from 30% to 58%.

– Gyeonggi-do: Manufacturing increased from 15% to 30%.

4. Population redistribution & infrastructure breakthroughs

The next question we raised was how the net migration rate of cities in the SMA changed with economic development and infrastructure construction. Before 1982, Seoul had a trend of positive net migration into the center. After switching to a multi-center model, the population shifted strongly to Gyeonggi-do – leading to resource redistribution and regional economic growth.

Infrastructure development in South Korea:

– 1980: 7.4 km metro and <100 km highways.

– 1995: 135 km metro and 227 km highways.

– 2010: 940 km metro and 1,000 km highways.

In the new Ho Chi Minh City:

– Currently: 19.7 km metro (Ben Thanh – Suoi Tien) and under 100 km highways.

– Target by 2035: >600 km metro and highways.

– A total of 6 metro lines are included in the city’s long-term master plan, with Line 1 already operational—marking a major milestone in Ho Chi Minh City’s journey toward a modern, connected metropolis.

5. Impact on the real estate market

While the Seoul Metropolitan Area’s economic transformation has been widely discussed, its real estate trajectory offers equally important insights.

– Between 2006 and 2009, property prices in Seoul SMA doubled.

-From 2010 to 2019, prices stabilized in the face of global economic uncertainty.

-In the 2019–2022 period, following the launch of South Korea’s “Global Seoul” strategy, housing prices surged again—doubling for the second time.

Currently, the market is on a recovery path, with prices showing a strong tendency to return to previous peaks.

6. Comparing the new Ho Chi Minh City and Seoul SMA – Opportunities ahead

With various aspects of the Seoul Metropolitan Area already examined, a comparison with the newly expanded, multi-center HCMC highlights a range of promising development opportunities across its emerging urban hubs.

First, the contribution rate of multi-center HCMC to Vietnam’s economy is highly significant, much like that of the Seoul Metropolitan Area prior to its formation. Both megacities concentrate enormous resources — a powerful advantage, yet also a challenge when it comes to ensuring efficient and balanced resource utilization across multiple urban centers.

Second, the proportion of the working-age population in the new Ho Chi Minh City is 70%, higher than that of Seoul metropolitan area (average 65%). A young population is an important resource and driving force for economic growth.

Third, the population density of Ho Chi Minh City (4,500 people/km²) is much lower than Seoul’s (13,000 people/km²). Lower density makes infrastructure development easier for the new Ho Chi Minh City.

Fourth, metro and highway infrastructure development. Let’s remember that before the Seoul metropolitan area was formed, South Korea had 7.4 km metro and under 100 km highways. Thirty years later, they developed to 940 km metro and 1,000 km highways. The new Ho Chi Minh City has 19.7 km metro (Ben Thanh – Suoi Tien line) and under 100 km highways. The goal is to reach more than 600 km of metro and highways by 2030–2035. Many of us may still doubt that it will take a long time to implement the next metro lines, but look at Seoul’s story: if public investment disbursement continues as decisively as now, it is entirely feasible, and I believe it will happen faster than many expect.

Final Note

The development of multi-center HCMC marks a historic turning point. Lessons from the Seoul Metropolitan Area show that when roles are clearly defined, investments are strategically focused, and urban planning remains consistent, a multi-nodal city like HCMC can absolutely achieve major breakthroughs in both economy and real estate.

Source: Batdongsan.com

For tailored real estate advice in Ho Chi Minh City, please contact us^^

호찌민시 부동산 상담이 필요하시면, 언제든지 문의해 주세요^^

Để được tư vấn bất động sản phù hợp tại TP.HCM, vui lòng liên hệ với chúng tôi^^![]() For Korean / English:

For Korean / English:

📱 Phone/Zalo: 03 9249 1949 (Mr. Kim)

💬 Kakaotalk ID: kdhrpm

💬 WeChat: LQ-kdh

📲 WhatsApp: +84 89 848 38 68![]() For Vietnamese / English:

For Vietnamese / English:

📱 Phone/Zalo: 09 3783 6896 (Oanh / Christine)