Compelling Correlation Insights from China and South Korea

The Economic Picture: How similar is Vietnam to China and South Korea?

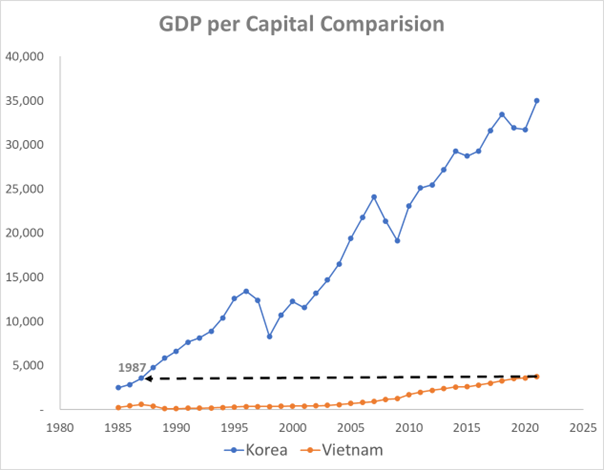

South Korea: Vietnam and South Korea share a similar historical background, as both countries have experienced periods of colonization, war, and post-war reconstruction. South Korea achieved independence in 1953, while Vietnam gained independence 22 years later and began its economic reform journey in 1960. Based on this timeline, there is a 30-year gap in the economic development of the two countries. Despite this disparity, the starting point of economic development for both nations was similar, characterized by underdeveloped agricultural economies and a lack of infrastructure in the aftermath of the war.

China: According to a report by MBS, Vietnam is currently showing several indicators that suggest similarities with China in a period 14 years ago. Looking back to 2008 in China, there are noticeable similarities between the two countries in terms of the proportion of the middle class, average income per capita, and urbanization rate. If Vietnam can maintain its current growth momentum, it is projected to reach a per capita income level equivalent to that of China in the coming years.

| China in 2008 | Vietnam in 2022 | |

| Middle-class (%) | 26% | 27.5% |

| Urbanization (%) | 45% | 39.8% |

| GDP per Capital | $3,468 | $3,756 |

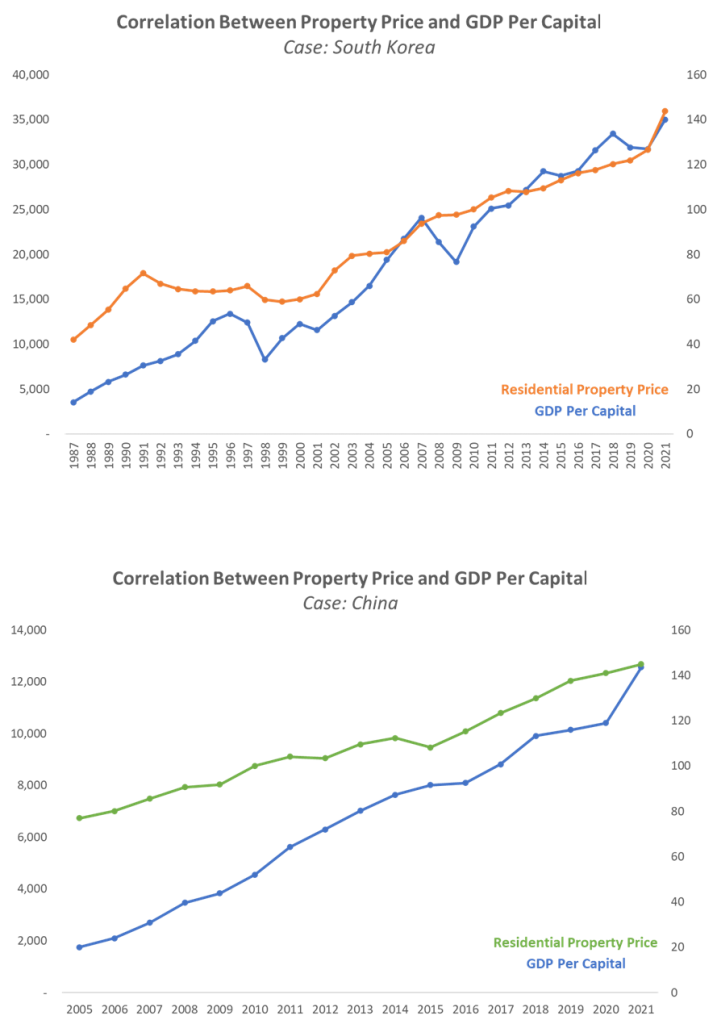

Unlocking the Secrets: The Tight Correlation between Real Estate Value and GDP

When examining the value of housing prices in two countries, South Korea and China, the real estate values observe a close relationship with the GDP growth rates of these two nations. Starting from 1985, South Korea demonstrated a similar movement between GDP per Capita and Residential Property Prices, with an intersection point in recent years. China paints a similar picture as well. Based on data from 2005, the fluctuation and deviation of these two indicators are remarkably similar, with a shared intersection point in 2021.

Considering the close correlation between GDP per capita and residential property prices, as well as the economic similarities among China, South Korea, and Vietnam, we can expect that the real estate value in Vietnam will follow the growth rate of the country in the future.

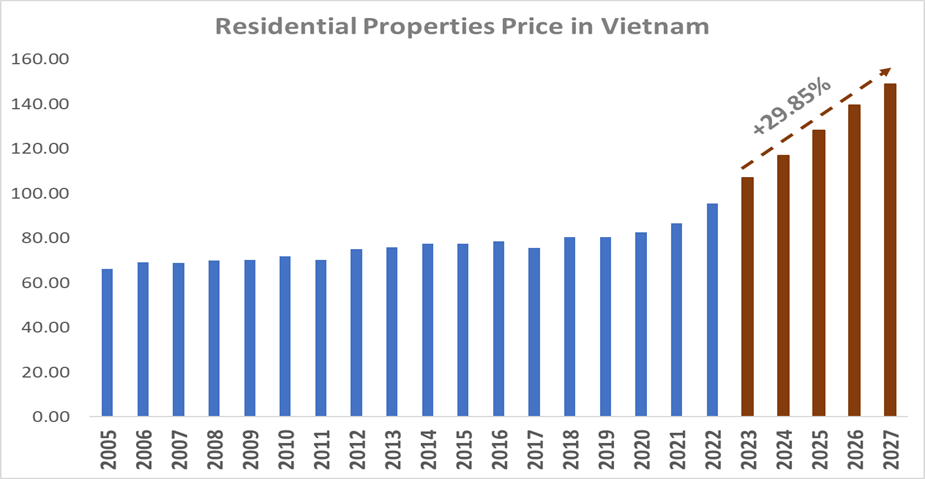

Economic Boom: A Promising Outlook for Vietnam’s Real Estate Market!

According to the IMF, Vietnam’s economy is projected to have an impressive growth rate of 29.85% over the next five years, reaching $6,600 by 2027.

Under the close correlation between economic growth and real estate values, we can expect the real estate market in Vietnam to experience a similar surge in the next five years. This will also mark the highest growth rate in the real estate market among Southeast Asian countries.