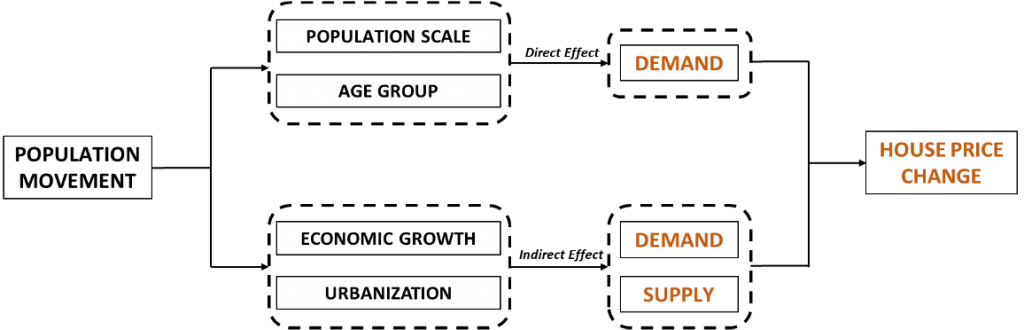

Population significantly influences the supply and demand factors of the real estate market, with direct and indirect implications for property prices.

According to the General Statistics Office of Vietnam (GSO), the average population growth rate in the past two decades has been 4.14%, positioning Vietnam as the 15th most populous country in the world and the 3rd in Southeast Asia.

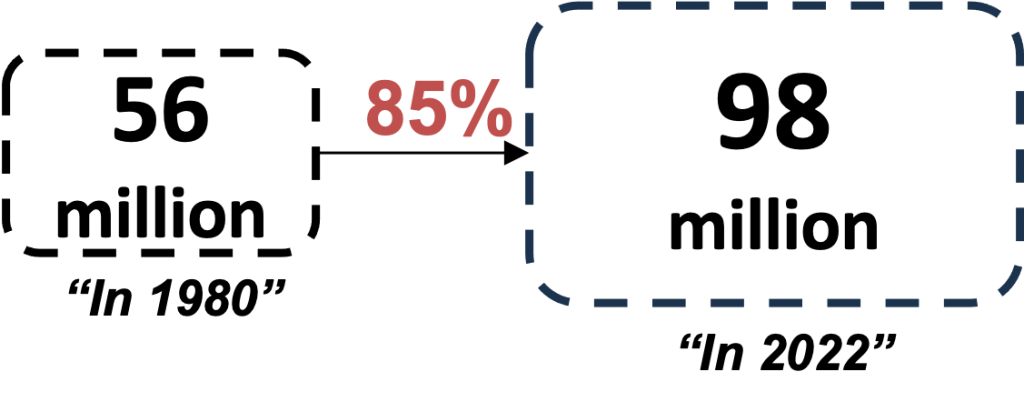

Vietnam’s population has experienced significant fluctuations since 1980, reaching a milestone of 98 million people in 2022. During this period of population growth, the period from 1990 to 2000 witnessed the most increase, with a staggering growth rate of nearly 11%. This growth rate placed Vietnam as the third fastest rise in the world, staying only behind China and India.

Vietnam’s “Golden Population” Structure: A Unique Growth Potential

Since 2007, when the dependency ratio (the ratio of the population aged 0-14 and over 65 to the population aged 15-64) fell below 50%, Vietnam officially entered the era of the “golden population” structure.

This demographic advantage presents Vietnam with an unparalleled growth opportunity. As the “golden population” era is projected to last until around 2038, the country can capitalize on this extended period to foster sustained economic development and social progress.

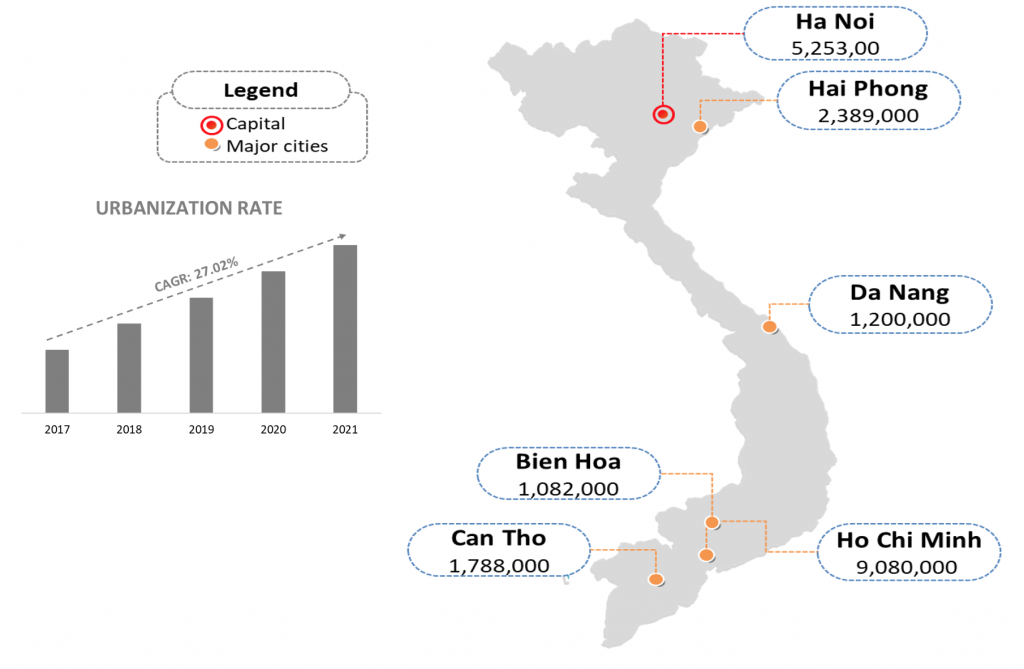

The rapid urbanization process in Vietnam is driving the long-term potential of the real estate market.

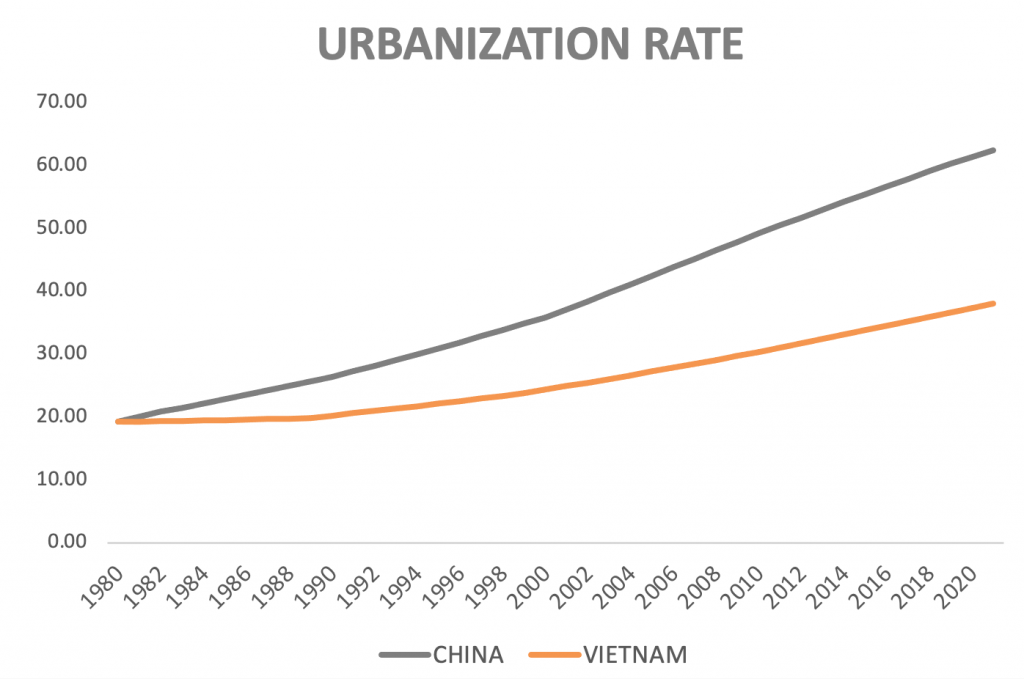

Since 1985, the average urbanization rate in Vietnam has been 4.74%. In the past five years, there has been a significant increase in the number of people migrating to urban areas, averaging 27.7% growth.

With rapid urbanization, the demand for housing and real estate has increased significantly.

According to the report of the World Bank, new urban projects, high-end residential areas, and mixed-use commercial and service complexes have emerged, contributing to high-value real estate in the market. Additionally, there has been an increase in demand for apartments, townhouses, and serviced residential areas, driving the buying and selling activities and transactions in the real estate sector.

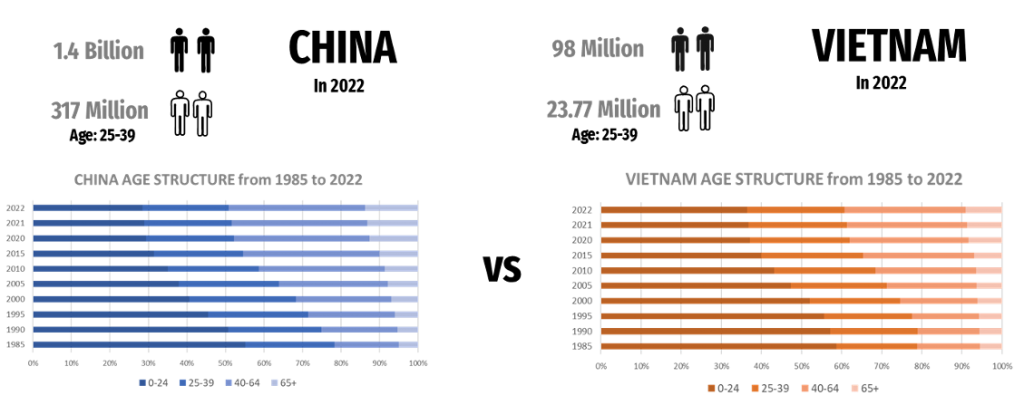

To predict the impact of these factors on the future growth of the real estate market, we have examined the most comparable economy, China for shaping the future image of Vietnam.

The Shifting Demographics: A Comparative Perspective Between China and Vietnam.

In a similar historical story, Vietnam and China both exhibit similarities in their social development over the years. Both countries have experienced significant population growth since 1980, with China and Vietnam recording growth rates of 45% and 85%, respectively.

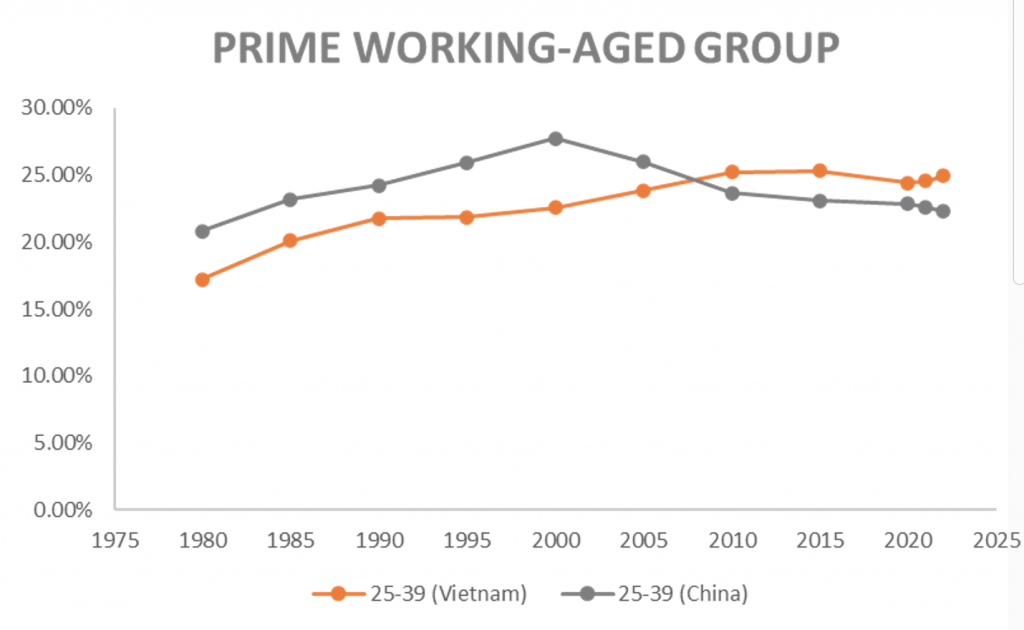

A more detailed population structure reveals a convergence in the trend of the prime working-age group (25-39) between the two countries in 2021. China has witnessed a reversal in growth within this demographic, while Vietnam continues to experience growth.

With the increase of the young population in both countries, the pace of urbanization in Vietnam and China has experienced significant growth. As a rapidly developing nation, Vietnam has witnessed a remarkable urbanization rate from 2010 to the present, reaching 11.34%, behind China by only 0.2%.

This growth marks a strong transformation in the Vietnamese real estate market as urban areas have expanded in terms of quantity, quality, and scale. It is estimated that each year, urban areas in Vietnam add between 1 to 1.3 million residents

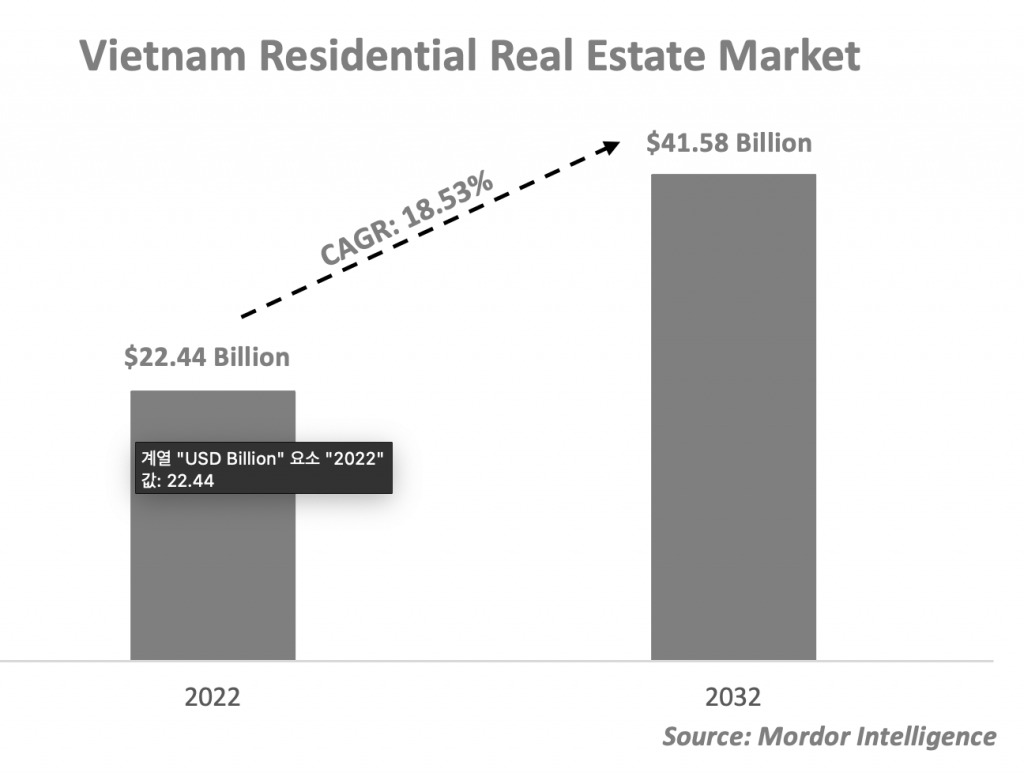

Looking ahead, the future of Vietnam’s real estate market appears promising, staying with the growth trend observed in China. As urban areas continue to expand in quantity, quality, and scale, the demand for housing and commercial spaces is expected to rise.

From the Field to the Skyscraper: The Growth of Real Estate Values in Vietnam from Population Factors

From the story of China, we can expect Vietnam’s real estate market in four aspects:

Urbanization Targets:

Demographic and Social Change:

Prime working-age group:

Average Age of the Population: