In recent years, Vietnam real estate market has witnessed the rapid emergence of mega urban developments, with project sizes expanding from hundreds to thousands, even tens of thousands of hectares.

This wave of mega projects is capturing investor attention and reshaping Vietnam’s urban structure and real estate future.

Contents

Historically, integrated townships in Vietnam were developed at several hundred hectares, rarely exceeding 1,000 hectares. In the North, examples such as Ecopark (500 ha) in Hung Yen or large-scale developments by Vingroup like Vinhomes Smart City (280 ha) and Vinhomes Ocean City (nearly 1,200 ha) set the benchmark for modern mega urban living.

In the South, Novaland emerged as a major player, accumulating a land bank of nearly 10,600 hectares by 2022, with an estimated development value of USD 71 billion. While Novaland’s flagship projects such as NovaWorld Phan Thiet (1,000 ha) and Aqua City (nearly 1,000 ha) – were considered massive at the time, they still fall short compared to the new generation of projects now entering the pipeline.

By 2025, Vietnam’s real estate market is seeing a clear escalation in scale. Large-scale projects spanning thousands to tens of thousands of hectares are no longer conceptual, but actively planned and announced.

This trend shows that developers are no longer betting on small-scale projects, but are shifting to a long-term strategy: creating complete urban areas with synchronized infrastructure, large enough to form a self-contained ecosystem for living, working, and entertainment. This marks a decisive shift in how major developers approach long-term urban development.

Vingroup continues to be at the forefront of this transformation. Building on the success of its previous integrated urban developments, the group has unveiled several projects that redefine scale in Vietnam’s real estate market.

One notable example is Vinhomes Green Paradise Can Gio, a development covering over 2,870 hectares. As a mixed-use urban-eco-resort complex, the project can reshape Ho Chi Minh City’s southern coastal gateway with environmental alignment.

Another landmark development is Ha Long Xanh Integrated Urban Area, spanning more than 4,100 hectares. Considered one of the largest waterfront urban developments in Southeast Asia, the project is planned to deliver over 55,000 residential and hospitality units, serving a projected population of more than 244,000 residents.

Perhaps the most ambitious proposal to date is the Olympic Sports Urban Area (Vin Olympic), spanning over 16,000 hectares across multiple districts in southern Hanoi. The project aims to develop a large-scale sports, tourism, and ecological urban complex hosting ASIAD or Olympic events.

Beyond just scale, the new generation of projects by Vingroup in general and other developers in particular aim to operate according to a multi-functional model: urban – education – healthcare – commerce – industry – logistics. The “city within a city” model enables super cities to function as self-sustaining hubs attracting residents, businesses, and services.

One of the most visible impacts of super cities is the shift of market focus away from traditional city centers. Locations once considered “too far” – such as Long Thanh, Can Gio, Duc Hoa, and Hoa Lac are now attracting strong investor interest. These areas benefit from better infrastructure, new job hubs, and an influx of young residents seeking affordable, well-planned living.

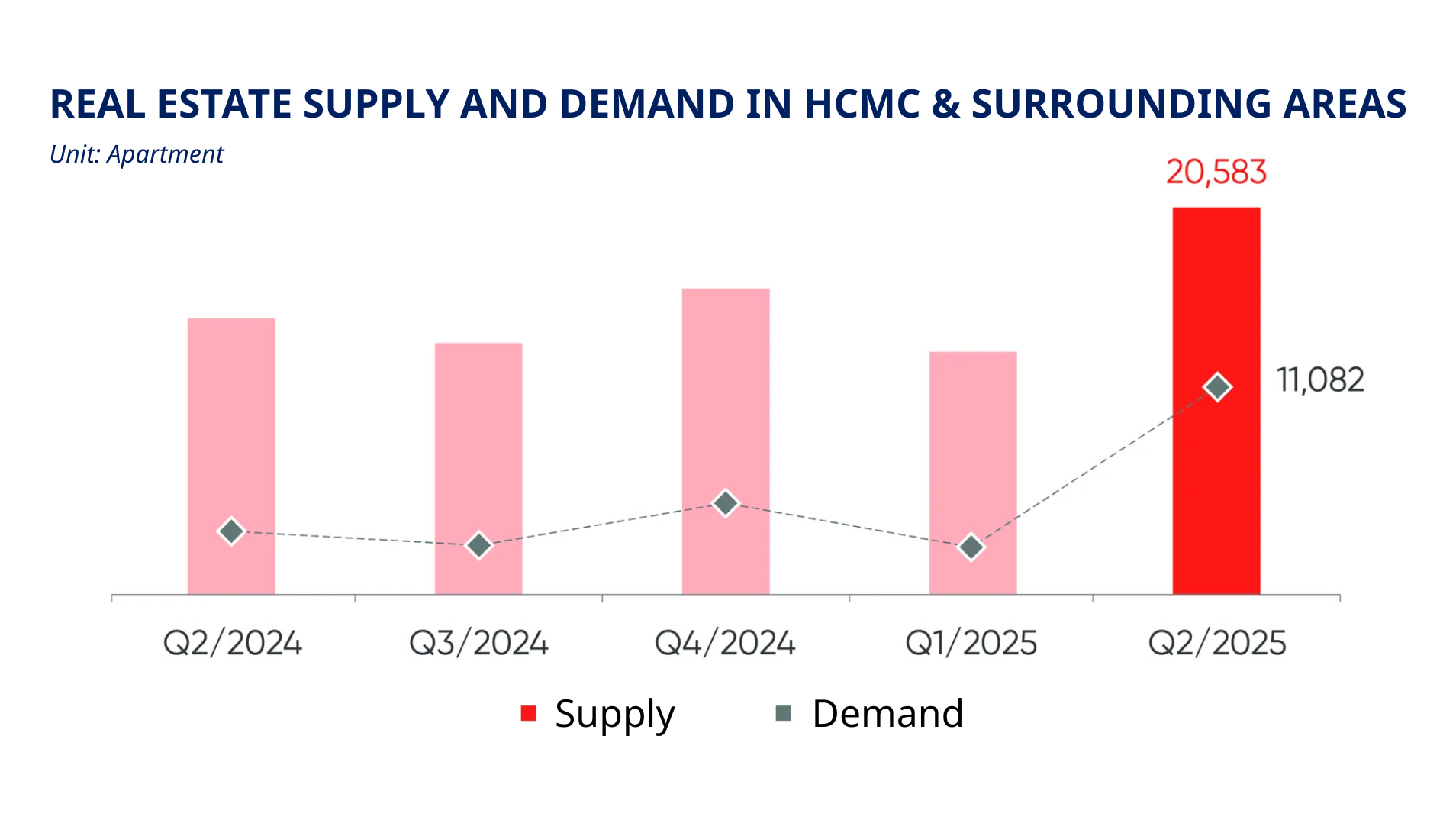

Super cities are also expected to play a role in balancing long-term supply and demand. Phased developments releasing tens of thousands of units provide supply volumes that smaller projects cannot compete with.

This scale enables phased supply, helping prevent sudden price spikes and reducing the risk of localized land speculation. While short-term fluctuations may still occur, the long-term outlook points toward greater price stability.

Buyer behavior is also evolving. Increasingly, homebuyers prioritize green spaces, education, healthcare, employment proximity, and integrated amenities over mere location. Super cities, with their all-in-one planning approach, align well with this shift. As a result, the market will polarize: well-planned large-scale projects gain traction, while poorly integrated smaller ones struggle.

Despite their potential, super cities also pose significant challenges. Their success depends heavily on regional infrastructure development. Without synchronized investment in expressways, ring roads, metro lines, and inter-regional connectivity, mega projects risk becoming underutilized “sleeping cities.” Therefore, 2025–2035 will be critical, requiring accelerated infrastructure investment to support next-generation urban development scale and ambition.

In the new development cycle, investors should prioritize large-scale projects with comprehensive master planning rather than fragmented, small developments. These projects benefit from longer development horizons, phased supply, and better resilience against short-term market volatility, making them more suitable for capital preservation and steady value growth.

Equally important is the evaluation of the developer’s financial capacity, execution track record, and long-term commitment. In large-scale urban developments, project success also depends on the developer’s ability to invest continuously in infrastructure, amenities, and community-building over 10–20 years. Investors should prioritize developers proven in mega projects and closely aligned with government planning and regional infrastructure development.

Investors are advised to follow infrastructure development and real housing demand with a medium- to long-term investment view. Areas connected to highways, ring roads, airports, and metro lines are more likely to attract real residents and businesses. In this context, success is less about “buying early and selling fast” and more about holding quality assets in the right locations, allowing time for urbanization and infrastructure to unlock long-term value.

With a mission to support international investors in Vietnam, La Quinta provides full market insights, forecasts, and legal updates to help investors make informed, effective decisions in this fast-growing market.

More potential real estate in the HCMC area